Curator Fees

Curators on Orion earn fees for designing and managing vaults. When you create a vault, you configure:

- Management fee - a recurring fee on total value locked (TVL) - assets under management (AUM), with a protocol-enforced maximum of 3% per year.

- Performance fee - a fee on generated returns, with a protocol-enforced maximum of 30% of profits.

Both fee types:

- Are subject to protocol-level maximums and guardrails - the UI and SDK prevent you from setting fees above these caps.

- Are subject to an immutable 7-day delay before changes take effect: when you change management fees, performance fees, or fee type/model, the change takes effect after 7 days. You can make additional changes at any time; if you make a new change before the 7 days are up, the timer resets for the new change, giving depositors time to react to pending changes. Users will see updated values in the app before they take effect.

Management Fees

Management fees compensate curators for ongoing portfolio design, monitoring, and operations.

- Basis: Charged as an annualized percentage of vault AUM (e.g., 1-2% per year), accrued continuously and settled on-chain at defined intervals.

- Collection: Typically taken in-vault by minting curator shares or by periodically siphoning a small portion of the vault’s assets, depending on the implementation.

Management fees are independent of performance; they accrue even if the vault is flat or down, within the configured thresholds.

Performance Fees

Performance fees align curator incentives with depositors by rewarding positive returns.

- Basis: Charged as a percentage of realized gains over a reference level.

- Timing: Crystallized on predefined events (e.g., rebalance, crystallization epoch, or withdrawal), depending on the strategy and vault configuration.

- Reference: Gains are always computed relative to a fee model that defines when and on what basis performance is measured.

Orion supports multiple performance fee models so curators can match their business model and investor expectations.

Supported Performance Fee Models

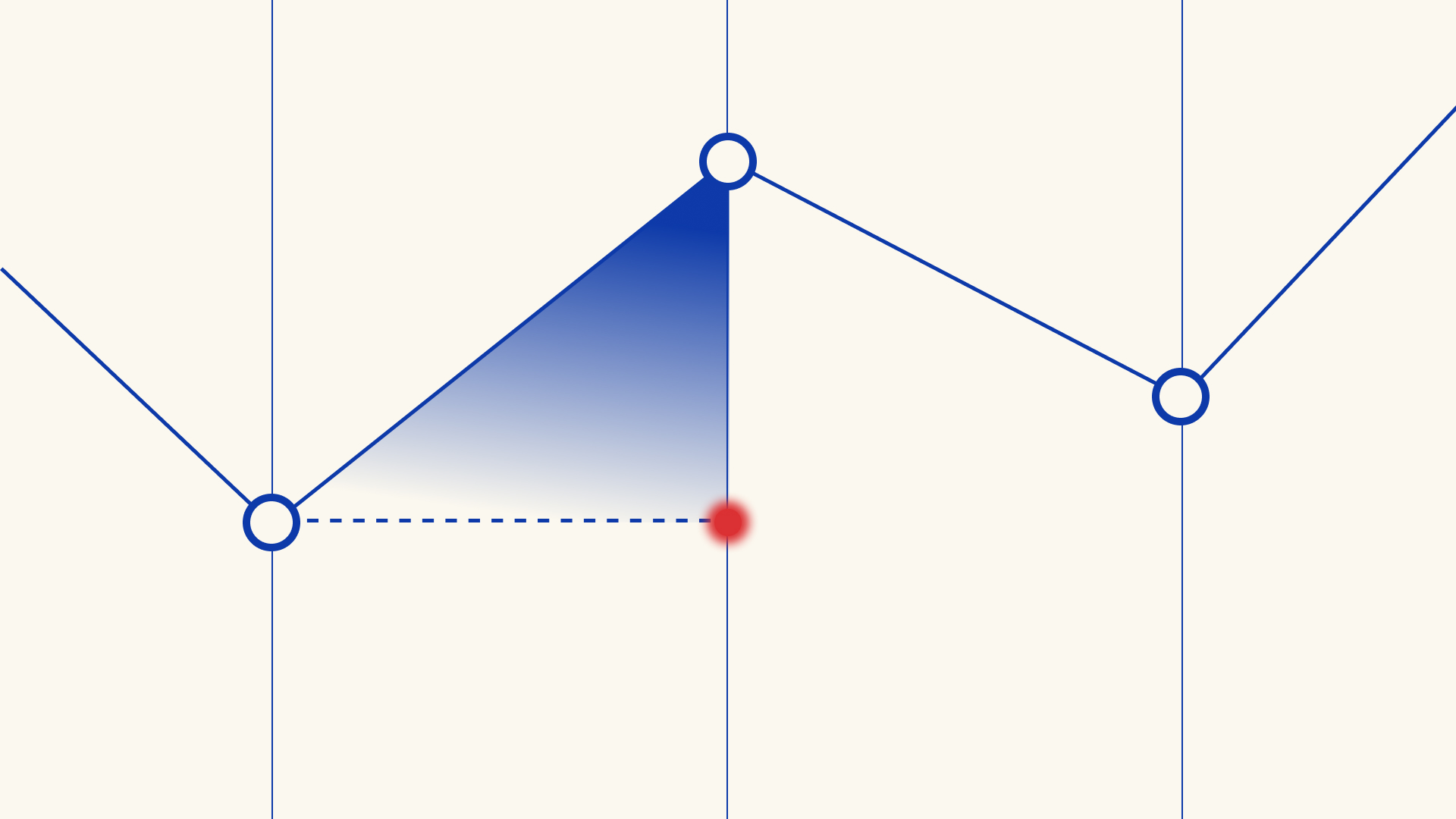

Absolute Return

In the absolute model, performance is measured against a flat baseline: any positive return from the starting point is fee-eligible.

- Reference level: Starting Net Asset Value (NAV) or the last crystallization point.

- Fees trigger when: The vault’s value is above this baseline; all positive Profit & Loss (P&L) since the last crystallization can be charged.

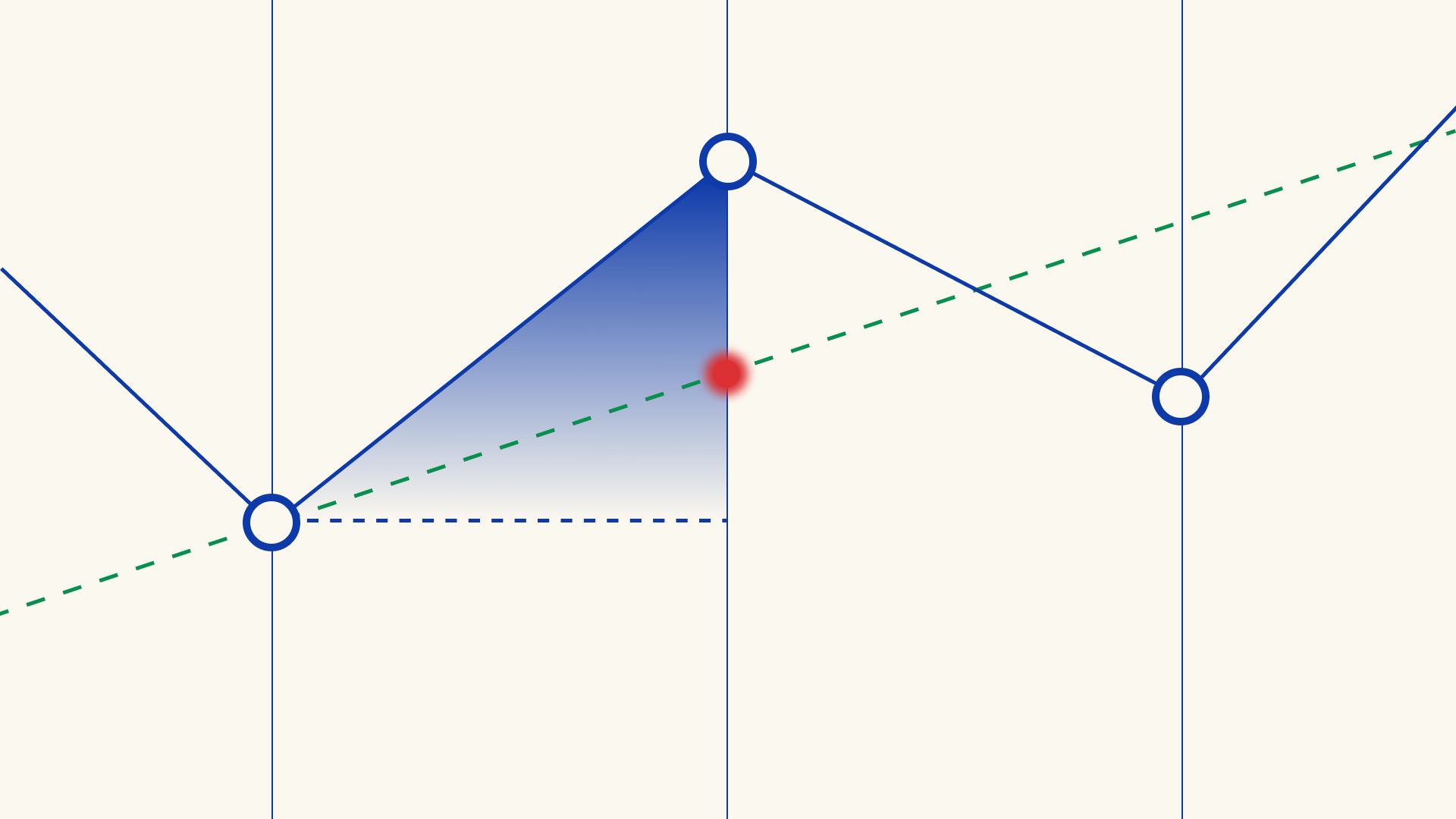

Hard Hurdle

A hard hurdle introduces a minimum required return before any performance fee can be charged.

- Reference level: Starting NAV plus a hurdle rate (e.g., +5%).

- Fees trigger when:

- The vault’s performance exceeds the hurdle level, and

- Only the return above the hurdle is fee-eligible.

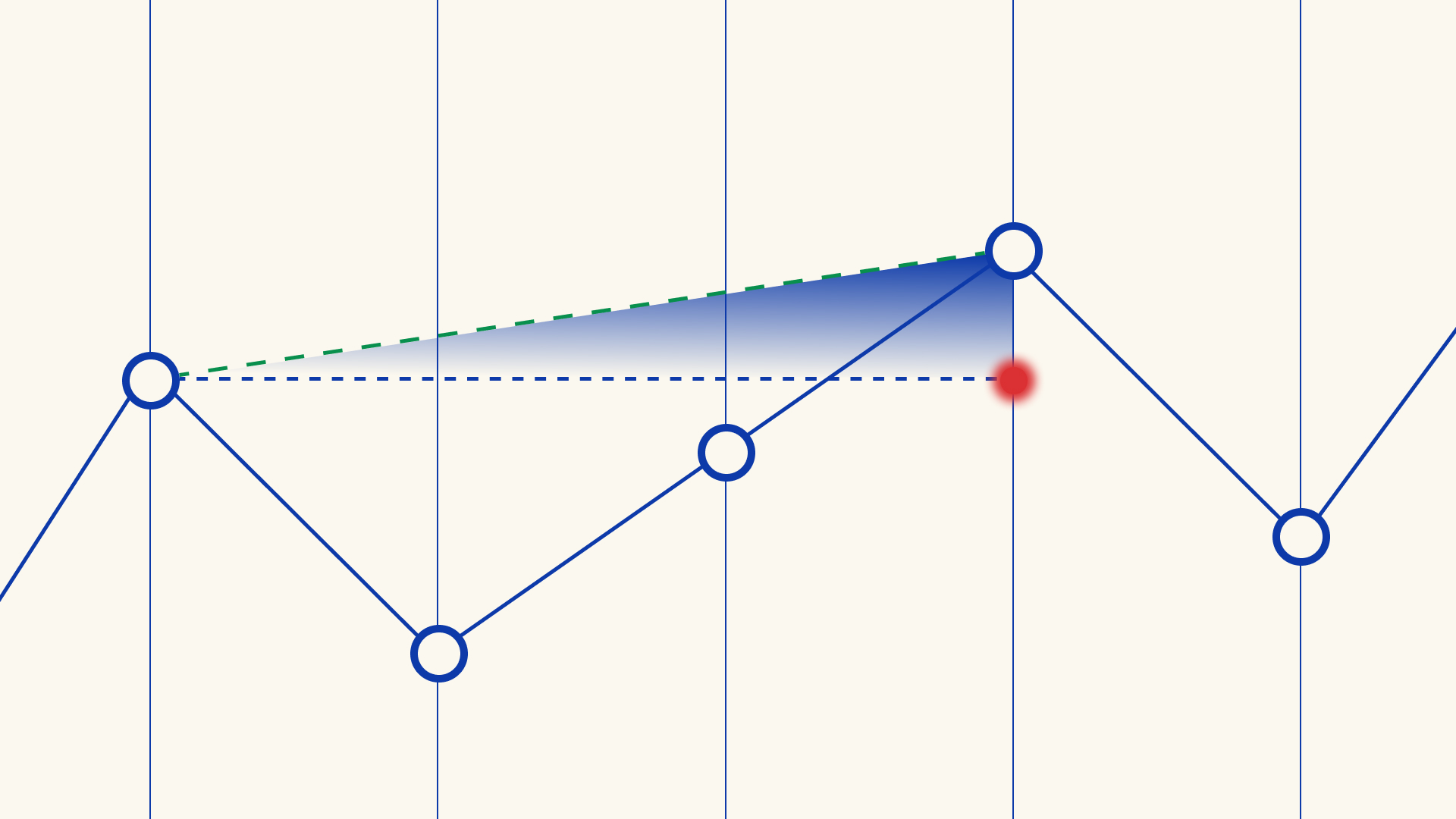

High Water Mark

A high water mark (HWM) ensures curators only earn performance fees on new highs in the vault’s value.

- Reference level: The highest historical NAV on which a performance fee has previously been charged (the “high water mark”).

- Fees trigger when:

- The vault’s value rises above the prior HWM, and

- Only gains above the previous peak are fee-eligible.

- Drawdown behavior: After a drawdown, no performance fees are charged until the vault value has recovered past the old HWM.

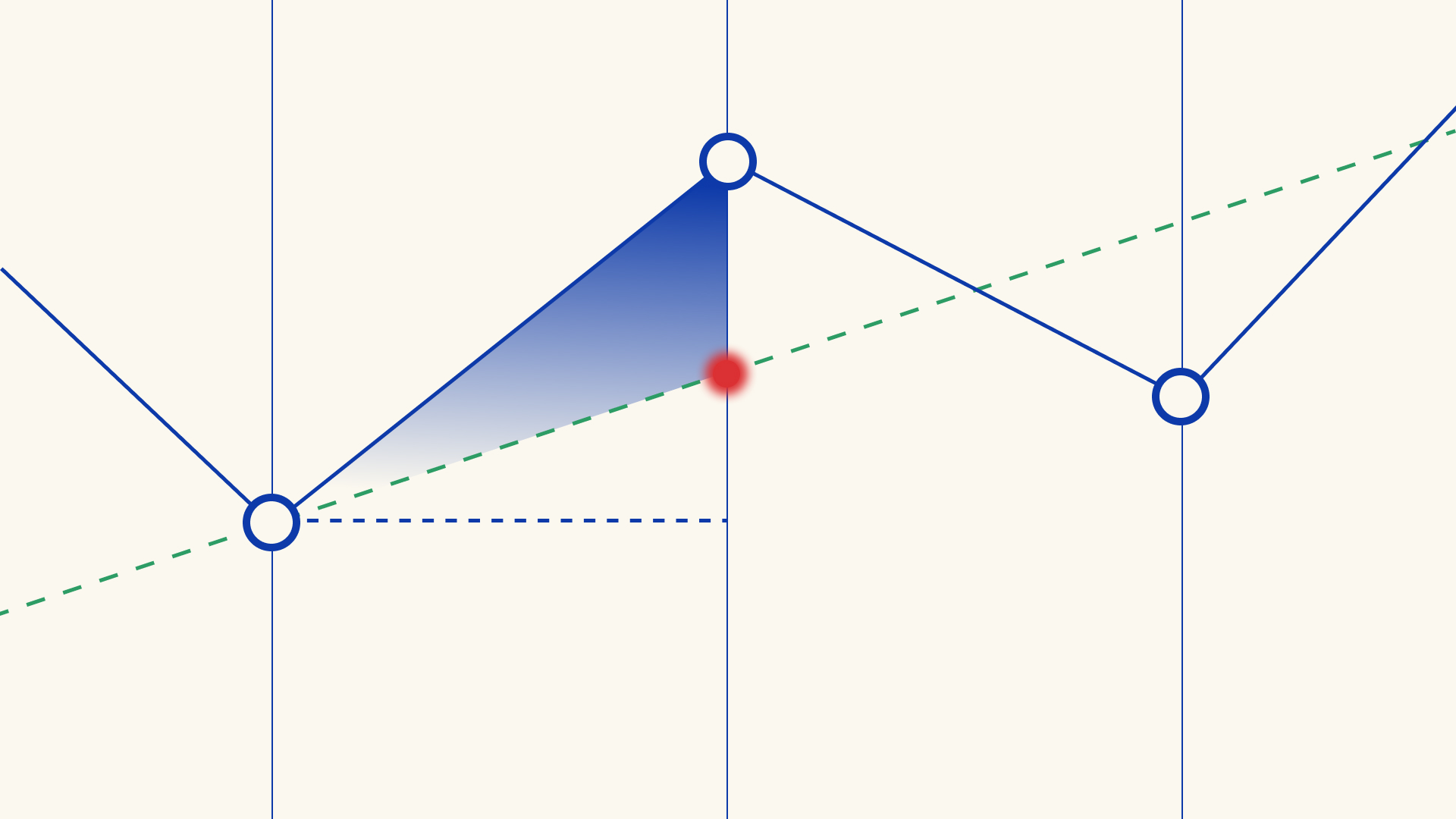

Soft Hurdle

A soft hurdle combines aspects of hurdle-based and absolute models.

- Reference level: Starting NAV plus a hurdle rate.

- Fees trigger when:

- Once the vault’s value exceeds the hurdle, performance fees can apply to all gains, not just the excess above the hurdle.

Protocol Fees

Protocol Revenue Share

- Revenue-share model: Orion earns a protocol fee as a share of curator fees.

- Default setting: The protocol currently takes 10% of the curator’s fee take (i.e., 10% of the total % of profits you earn as fees).

- Accounting: This split is handled automatically at the protocol level; you configure your gross fees, and the protocol retains its share from that amount.

- Maximum Protocol Fee: 20% (currently configured at 10%).

Withdrawing Accrued Fees

Both curators and the protocol can withdraw accrued fees:

- You may request to withdraw all or part of the fees that have accumulated.

- Withdrawals follow the protocol’s accounting and crystallization logic and do not affect user-facing fee percentages beyond what has already accrued.

- Operationally, this allows you to realize fee revenue while keeping vault accounting clean and verifiable onchain.

Choosing Your Fee Configuration

When configuring a vault:

- Set fees for:

- Management;

- Performance;

- Choose the fee type: absolute, hard hurdle, high water mark, or soft hurdle.

Best practices for curators:

- Align incentives - choose fee levels that are attractive to depositors while reflecting your strategy’s complexity and cost.

- Communicate clearly - proactively communicate any future fee changes to existing and prospective depositors.

- Consider volatility - strategies with high volatility often pair well with HWM or hurdle-based structures to avoid over-charging in choppy markets.

With Orion, fee accounting and crystallization are handled automatically by the protocol, so curators can focus on designing strategies and managing portfolios.