Financial Machine Learning

Orion is built on the principle that financial machine learning can make portfolio management radically more accessible.

We see financial machine learning as a tool to:

- Simplify decision-making for everyday users;

- Enhance performance for advanced managers;

- Automate allocation in dynamic market conditions.

To support a diverse range of user needs and intents, Orion enables two core approaches:

- Passive portfolio construction, powered by DeFi-native indexing and onchain metrics;

- Active, ML-driven management, where models optimize allocation and rebalancing.

This dual system lets vaults range from hands-off, rules-based strategies to fully performance-seeking allocations within Orion’s unified framework.

DeFi-Native Indexing

Orion enables a marketplace for onchain indexes, passive portfolios based on predefined rulesets, rebalanced automatically, and tokenized as ERC-20s.

We are building a system where:

- Managers define index weights based on asset classes, themes, or rulesets;

- Orion integrates APIs from skfolio to define quantitative finance metrics (e.g., covariance, tail risk, train-test split) that inform onchain vault behavior.

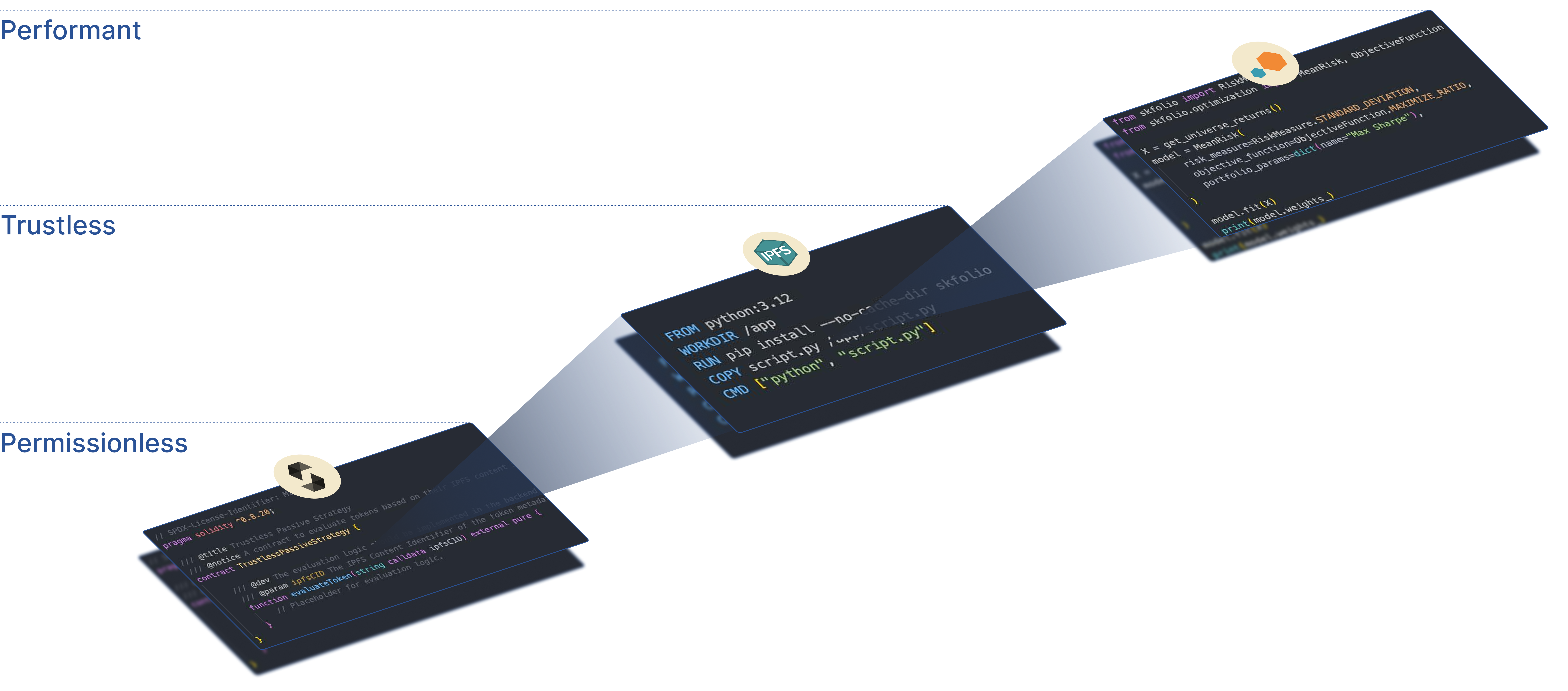

- Index logic is encoded onchain via IPFS CIDs pointing to dockerized portfolio management logic, ensuring deterministic and verifiable index construction.

Example of a ruleset

from skfolio import RiskMeasure

from skfolio.optimization import MeanRisk, ObjectiveFunction

X = get_universe_returns()

model = MeanRisk(

risk_measure=RiskMeasure.STANDARD_DEVIATION,

objective_function=ObjectiveFunction.MAXIMIZE_RATIO,

portfolio_params=dict(name="Max Sharpe"),

)

model.fit(X)

model.weights_

This enables a whole new layer of user-defined and trustless indexes, based on advanced and computationally intensive financial machine learning rulesets.

Trust Guarantees

Every step of this process is verifiable and reproducible:

- Provenance: Methodology + data pinned on IPFS and CID pinned onchain;

- Reproducibility: Anyone can rerun the pipeline and validate the output;

- Audit Trail: All updates and rebalances are logged transparently onchain.

Active Management: ML-Optimized Vaults

For managers seeking more sophisticated exposure, Orion supports financial machine learning (FML) pipelines that inform allocation, rebalancing, and dynamic optimization.

Our approach draws inspiration from academic and institutional-grade tools such as:

- Hierarchical risk parity;

- Expected return models;

- Online learning for portfolio allocation.

These models are either:

- Hardcoded into the vault strategy, based on parameterized ML outputs, or

- Queried dynamically via oracles or offchain computation layers (e.g., zkML, verifiable compute).

Orion abstracts this complexity for users, providing data, SDKs and tooling, while allowing managers and strategists to go deeper: tuning model parameters, overriding logic, or composing hybrid strategies.